Expanding Education Access

We believe every student deserves a great education

Mentorship for the Motivated

Applying to university is confusing, stressful and expensive.

Dyad's mentorship platform guides students through the admissions and scholarship process with free online events and a free library of instructional articles and videos.

Since our founding at Cambridge University in 2012, we've been on a mission to expand education access.

Informing and Inspiring Students

We pair motivated students with expert mentors from their target universities for 1-on-1 video calls, application strategy sessions, and document reviews.

We help students build effective habits, discover and cultivate their interests, and then confidently navigate the admissions and scholarship process to find the best university fit and get the best deal.

Impact

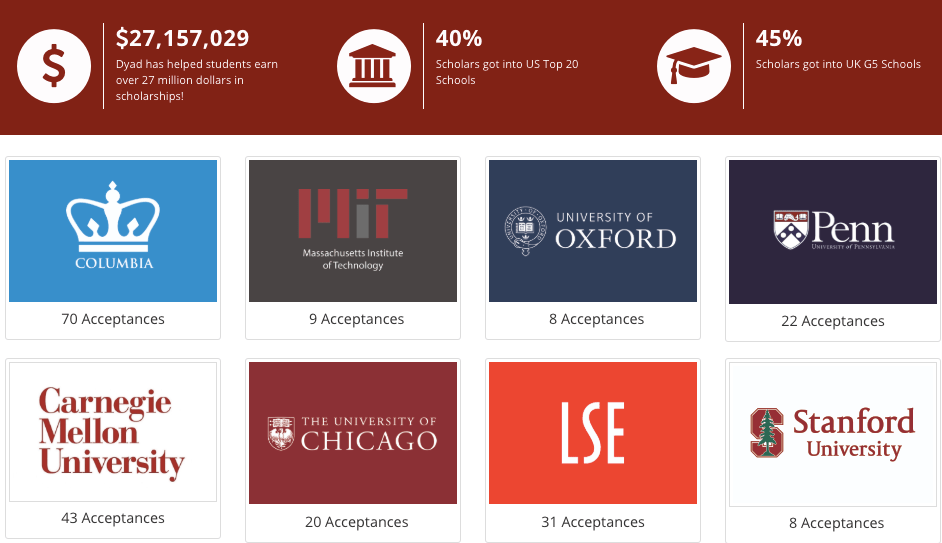

We've helped over 2,000 clients earn $27 Million in university scholarships!

Dyad is a trusted name in global education

Our innovative mentorship model has been featured in

Contact Us

We provide mentorship for the motivated. Get in touch!

Dyad Mentorship © 2012-2021